**Introduction:

DAX (Deutscher Aktienindex) is a stock market index consisting of the 40 major German companies trading on the Frankfurt Stock Exchange. Analyzing historical DAX data can provide valuable insights for financial analysis, evaluating market trends, and making informed investment decisions. In this blog post, we will delve into the significance of historical DAX data, ways to access and analyze it, and its application in financial analysis.**

Importance of Historical DAX Data:

1. Trend Analysis: Historical DAX data allows analysts to identify and analyze long-term market trends. By examining price movements, trading volumes, and other indicators over an extended period, investors can gain a deeper understanding of market behavior.

-

Risk Management: Historical DAX data enables investors to assess the volatility and risk associated with DAX securities. By studying past performance, investors can anticipate potential risks and take appropriate measures to manage them effectively.

-

Performance Evaluation: Comparing current market conditions with historical DAX data helps in evaluating the performance of individual stocks or the market as a whole. This analysis can aid investors in assessing the profitability and growth potential of their investments.

Accessing Historical DAX Data:

1. Online Financial Platforms: Numerous financial websites and platforms provide historical DAX data, including daily price movements, closing prices, and trading volumes. Websites like Yahoo Finance, Investing.com, and Bloomberg offer comprehensive historical data for in-depth analysis.

-

Data Providers:** Professional data providers such as Refinitiv Eikon, Bloomberg Terminal, and FactSet offer access to detailed historical DAX data along with advanced analytical tools. These platforms cater to institutional investors, financial professionals, and researchers requiring robust data sets.

-

APIs and Data Feeds: Developers and analysts can utilize APIs and data feeds provided by stock exchanges, market data vendors, and financial institutions to access real-time and historical DAX data. These tools enable users to integrate data directly into their analysis tools and systems.

Analyzing Historical DAX Data:

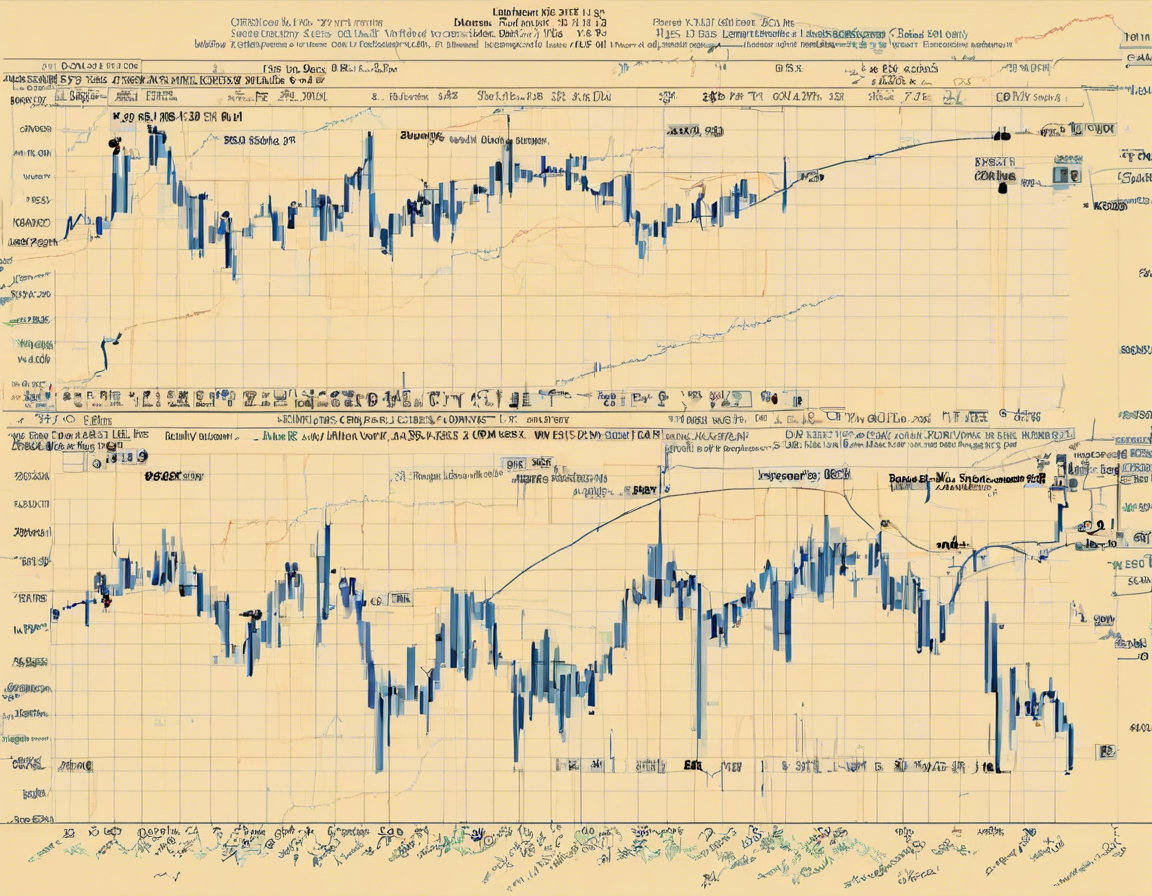

1. Technical Analysis: Utilizing technical indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can help analyze historical DAX data for potential price trends and entry/exit points. Technical analysis focuses on price patterns and market dynamics to forecast future price movements.

-

Fundamental Analysis:** Fundamental analysis involves evaluating financial statements, economic indicators, and company performance to assess the intrinsic value of DAX-listed stocks. By analyzing historical financial data, investors can gauge the financial health and growth prospects of individual companies.

-

Sentiment Analysis:** Monitoring market sentiment through news articles, social media, and financial reports can provide valuable insights when analyzing historical DAX data. Sentiment analysis helps investors understand market perceptions, investor confidence, and potential market reactions.

Application in Financial Analysis:

1. Portfolio Management: Historical DAX data plays a crucial role in portfolio management by helping investors diversify their holdings, optimize asset allocation, and rebalance their portfolios based on past performance trends.

-

Risk Assessment:** By examining historical DAX data, investors can assess the risk-return profile of their investments, identify correlations between assets, and implement risk management strategies to protect against market volatility.

-

Performance Benchmarking:** Comparing portfolio returns with historical DAX performance benchmarks allows investors to evaluate the effectiveness of their investment strategies, identify underperforming assets, and make data-driven decisions to enhance portfolio performance.

**Frequently Asked Questions (FAQs):

- What is the best source for accessing historical DAX data?

-

Online financial platforms like Yahoo Finance and Investing.com offer free access to historical DAX data. For more advanced analysis, professional data providers such as Bloomberg Terminal and Refinitiv Eikon are recommended.

-

How far back can I access historical DAX data?

-

Historical DAX data typically dates back several decades, allowing investors to analyze long-term trends and performance. Popular financial platforms offer historical data ranging from a few years to several decades.

-

How can I use historical DAX data for risk management?

-

By analyzing historical price movements, volatility, and correlations with other assets, investors can assess the risk associated with DAX securities. This analysis aids in formulating risk management strategies to mitigate potential losses.

-

Is technical analysis or fundamental analysis more effective when analyzing historical DAX data?

-

Both technical and fundamental analysis have their merits. Technical analysis focuses on price patterns and market trends, while fundamental analysis evaluates a company’s financial health and growth prospects. Combining both approaches can provide a comprehensive analysis.

-

How often should I analyze historical DAX data for investment decisions?

- Regularly reviewing historical DAX data is essential for staying informed about market trends and performance. Depending on your investment horizon and risk tolerance, conducting weekly or monthly analyses can help in making informed investment decisions.

In conclusion, historical DAX data serves as a valuable resource for investors, analysts, and researchers looking to gain insights into market behavior, identify trends, and make informed decisions. By leveraging historical data through various analytical approaches, investors can enhance their financial analysis capabilities and optimize their investment strategies for long-term success.